IRA Rollover Law Now Permanent

IRA owners ages 70½ and older can make direct gifts to charity.

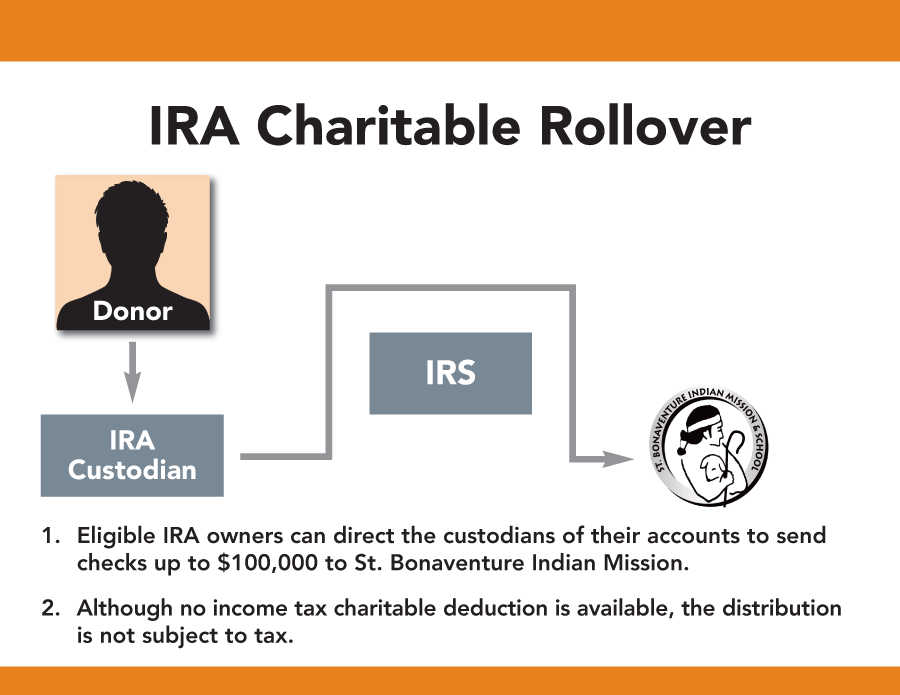

Eligible IRA owners can direct the custodians of their accounts to send checks up to $100,000 to charity. Although no income tax charitable deduction is available, the distribution is not subject to tax, as it would be if the IRA owner made a withdrawal and then gave the funds to charity. Qualified charitable distributions also satisfy required minimum distributions, providing tax savings.

Congress Encourages IRA Gifts by People Over Age 70½

The qualified charitable distribution allows people ages 70½ and older to instruct IRA trustees to make transfers to charity without incurring taxable income on those amounts. Up to $100,000 per year can be given in this manner. Even if you don't have to take required minimum distributions until age 72 (those ½ in 2020 or later), you can still make tax-free gifts from your IRA.

No income tax deductions are available for IRA gifts, but IRA donors can still save significant taxes. In fact, making charitable contributions through your IRA can enable you to increase the size of your gifts absolutely free.

How Does the Law Let Me Increase My Gifts at No Cost?

IRA funds are heavily taxed whenever you draw them out, at rates as high as 37%. What’s more, the tax burden never goes away – even your heirs will pay income tax on IRA funds they receive from your estate, and federal estate taxes may apply, as well — for estates exceeding $12,060,000.

There is a satisfying alternative: Instead, you can divert the tax collector’s take from your IRA to us.

Gift Ideas with Your IRA

- Significant Gifts. Phyllis has planned to leave us most of her IRA at her death, but wishes she could see her gift at work now, during her lifetime. Phyllis plans to direct a $100,000 gift from her IRA and avoid income taxes.

- Annual Distribution Gifts. Under the law, IRA contributions count toward mandatory annual distributions required of individuals over age 72. That means IRA gifts can reduce taxes. Robert, for example, must withdraw $20,000 from his IRA, even though he doesn’t need the money for living expenses. If Robert wishes, he can direct a $20,000 transfer to us prior to taking any distribution and reduce his federal taxes by $4,800 in his 24% tax bracket. Other tax savings may occur, as well.

IRA Gift Rules

- Donors must be past the age of 70½ and own a traditional or Roth IRA – other retirement plans such as pensions, 401(k) plans and others are not eligible.

- Only the IRA trustee can transfer gift amounts to a qualified organization. If IRA owners withdraw funds and then contribute them to charity separately, amounts withdrawn will be included in the donor’s gross income.

- No charitable deductions are allowed, but gift amounts will not be included in donors’ incomes.

- IRA gifts may not exceed $100,000. The ceilings on contribution deductions (60% of adjusted gross income for cash, 30% of AGI for long-term capital gain property) do not apply to IRA gifts.

- Transfers are not permitted to donor advised funds, private foundations or supporting organizations.

- IRA gifts cannot be made to charitable remainder trusts or other life income gift arrangements.

- To make an IRA gift, just contact the trustee of your account. Please call our office if you plan to make a gift from your IRA so we can ensure proper transfer of your gift and provide the substantiation you’ll need.>

IRA Gifts Have Special Appeal for:

- Donors who have an IRA and are over the age of 70½. Even those who don't need to take required minimum distributions until age 72 (IRA owners turning 72½ in 2020 or later), may make qualified charitable distributions from IRAs. Other retirement accounts, such as 401(k) plans, are not eligible, although it may be possible to roll over these plans into IRAs and then make qualified IRA gifts.

- Donors who use the standard deduction. Income tax deductions are not available for IRA contributions, but gifts are exempt from all federal taxes, which may be important to donors who do not itemize their deductions. IRA gifts make a detour around the tax collector, so donors who don’t itemize won’t need a charitable deduction to offset taxes.

- Friends who wish to avoid tax on required minimum distributions. IRA gifts will count toward the minimum distributions required of individuals over age 72 and reduce their taxes. Important: this tax break generally won’t be available if you have already received your minimum distribution for the year. Be sure to make your IRA gift before taking a required distribution.

- People who want to reduce taxes on their estates, for the few estates subject to tax. IRAs are subject to both income taxes and estate taxes after the owner dies, resulting in overall taxes of 60% or more. Making qualified IRA gifts avoids these taxes.

- Donors who can’t deduct all their contributions. The most a person can deduct for charitable gifts in any year is 60% of AGI (excess deductions can be carried over for up to five years). But gifts made directly from IRAs aren’t considered under this 60% limitation, which allows extra tax benefits for friends who wish to make large gifts this year.

Are You Too Young for IRA Giving?

For many years, advisers have been telling people that retirement accounts are the very best thing to leave to worthwhile organizations in their estate plans.

People of any age can name us as a partial or 100% death beneficiary of an IRA, 401(k), 403(b) plan, or other retirement account and avoid taxes. You also can leave your retirement account to a trust that will pay income for life to a spouse or family member, with later benefits for our programs. Contact us for full details.

- Learn More

- Recent Tax Laws

- Personal Planning Ideas

- IRA Charitable Rollover

- Best Assets for Giving

- Charitable Gift Annuity

- Gifts That Pay You Income

- Gifts from Estate Plans

- Free Online Courses

- Estate Planning Lessons

- Estate Planning for Women

- Practical Pointers

- Design Your Gifts

- Chart Your Path

- Important Terms

- Facts for Advisors

- Seasons of Life

- Library and Resources

- Donor Stories

- Help Desk

- What’s New

- Contact Us

- Home