Charitable Gift Annuity

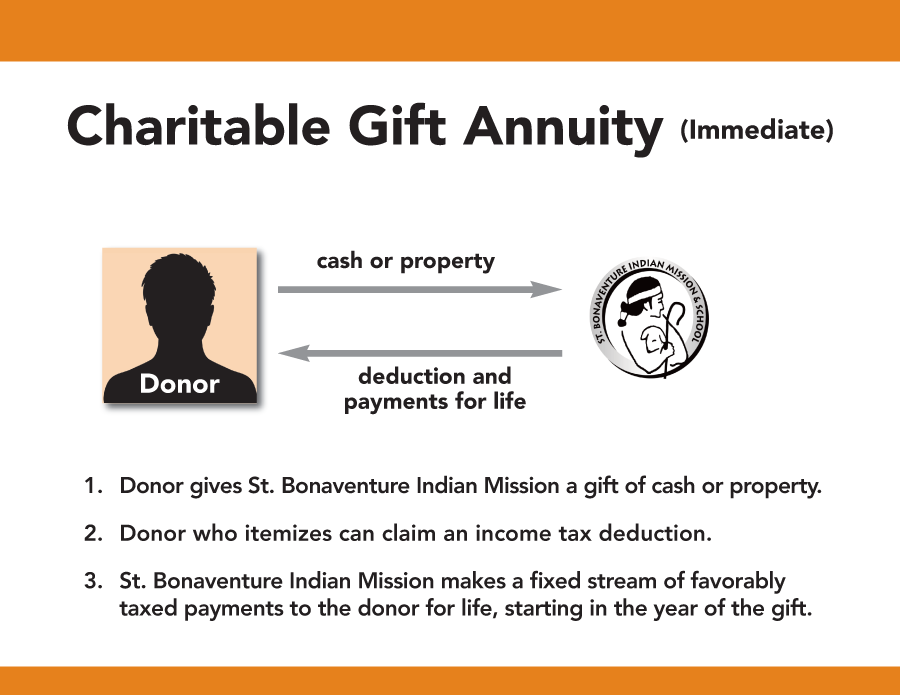

The charitable gift annuity is a way for donors to satisfy their goals of financial security and benefit the work of a favorite charity. A charitable gift annuity is a contract in which the donor transfers cash or other property to a charitable organization in exchange for fixed payments each year for the rest of the donor’s life (or for the lives of two people). A charitable gift annuity offers donors the opportunity to receive payments for life and a tax deduction. If appreciated assets are contributed for a gift annuity, capital gains tax and investment income tax savings are also possible. Gift annuity payments are backed by the assets of the charity, offering donors added assurance.

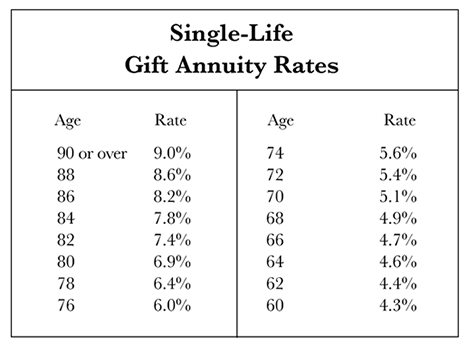

Generally speaking, the amount of the annuity is determined by two factors: the age of the donor and the size of the donor’s gift. Most, but not all, charities pay annuities based on the rates recommended by the American Council on Gift Annuities. One-life rates range from 4.3% at age 60 to 9.0% at age 90 (check chart below), depending on the age of the beneficiary; two-life rates are somewhat lower to reflect the longer combined life expectancies of the two beneficiaries.

Charitable gift annuities funded with cash allow for maximum tax-free payments while gifts of appreciated securities allow donors to minimize capital gains tax and investment income tax. A portion of the capital gains tax is avoided, while the remaining capital gains tax is spread over the donor’s life expectancy.

A deferred gift annuity is a unique arrangement that allows donors to make an immediate gift for the charity’s benefit and begin receiving annuity payments at some future time that the donor selects. The donor is allowed an immediate income tax deduction in the year the gift is made. The deduction helps offset the cost of the gift.

Remember that the charitable gift annuity is an irrevocable gift commitment, but one with excellent tax and financial benefits.

- Learn More

- Recent Tax Laws

- Personal Planning Ideas

- IRA Charitable Rollover

- Best Assets for Giving

- Charitable Gift Annuity

- Gifts That Pay You Income

- Gifts from Estate Plans

- Free Online Courses

- Estate Planning Lessons

- Estate Planning for Women

- Practical Pointers

- Design Your Gifts

- Chart Your Path

- Important Terms

- Facts for Advisors

- Seasons of Life

- Library and Resources

- Donor Stories

- Help Desk

- What’s New

- Contact Us

- Home