Chart Your Path

Outright Contributions

Income Tax Deduction Capital Gains Considerations Date Gift Is Effective Method of Transfer Valuation of Gift Assets Substantiation Requirements Special Considerations |

• Common & Preferred Stock • Corporate Bonds Income Tax Deduction Capital Gains Considerations Date Gift Is Effective Method of Transfer Valuation of Gift Assets Substantiation Requirements Special Considerations |

IRA owners ages 70½ and older can make charitable gifts directly from their IRAs of up to $100,000 and exclude those amounts from taxable income. Income Tax Deduction Capital Gains Considerations Date Gift Is Effective Method of Transfer Valuation of Gift Assets Substantiation Requirements Special Considerations |

Income Tax Deduction Capital Gains Considerations Date Gift Is Effective Method of Transfer Valuation of Gift Assets Substantiation Requirements Special Considerations |

Income Tax Deduction Capital Gains Considerations Date Gift Is Effective Method of Transfer Valuation of Gift Assets Substantiation Requirements Special Considerations |

Income Tax Deduction Capital Gains Considerations Date Gift Is Effective Method of Transfer Valuation of Gift Assets Substantiation Requirements Special Considerations |

Income Tax Deduction Capital Gains Considerations Date Gift Is Effective Method of Transfer Valuation of Gift Assets Substantiation Requirements Special Considerations |

Gifts with Retained Benefit

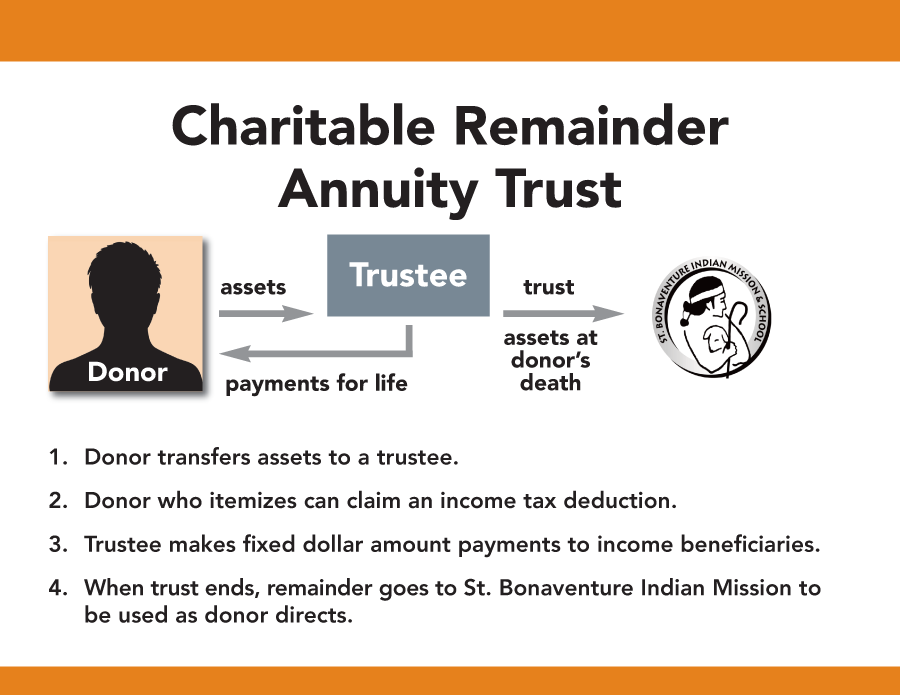

The donor funds a qualifying trust under Code §664, providing a fixed annuity (minimum 5% of the original value of the principal, maximum 50%) for one or more individuals. The trust may last for the lifetimes of the beneficiaries or a term of years (maximum 20 years). When the trust ends, the principal passes to one or more qualified charities. No additional contributions are permitted to the trust. Income Tax Deduction Capital Gains Consequences Federal Taxation Transfer Taxes Tax Returns Best Funding Assets Special Consideration |

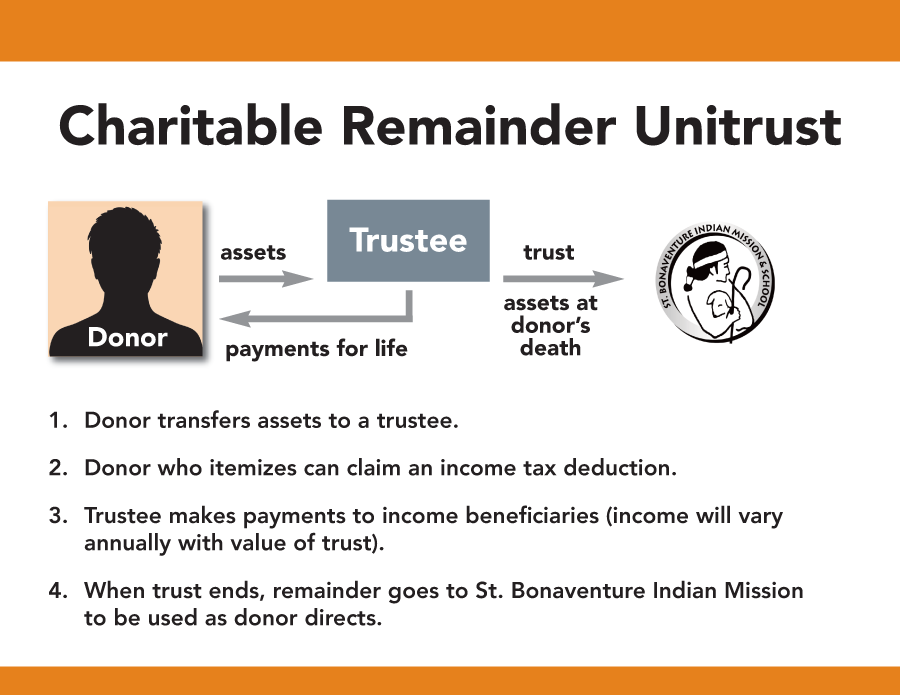

Summary of Gift Plan Income Tax Deduction Capital Gains Consequences Federal Taxation Transfer Taxes Tax Returns Best Funding Assets Special Considerations |

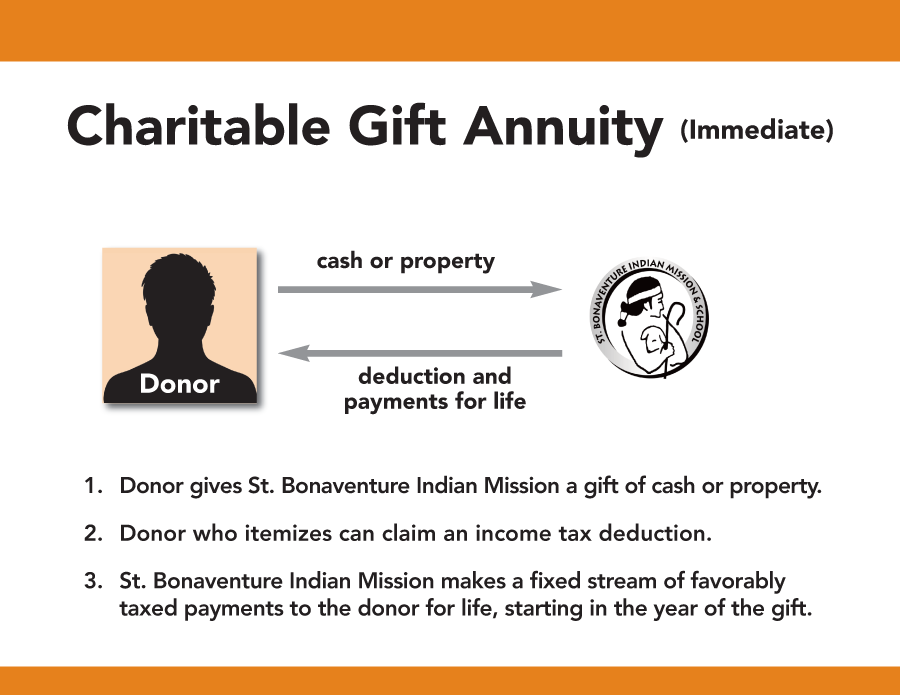

Summary of Gift Plan Income Tax Deduction Capital Gains Consequences Federal Taxation Transfer Taxes Tax Returns Best Funding Assets Special Considerations |

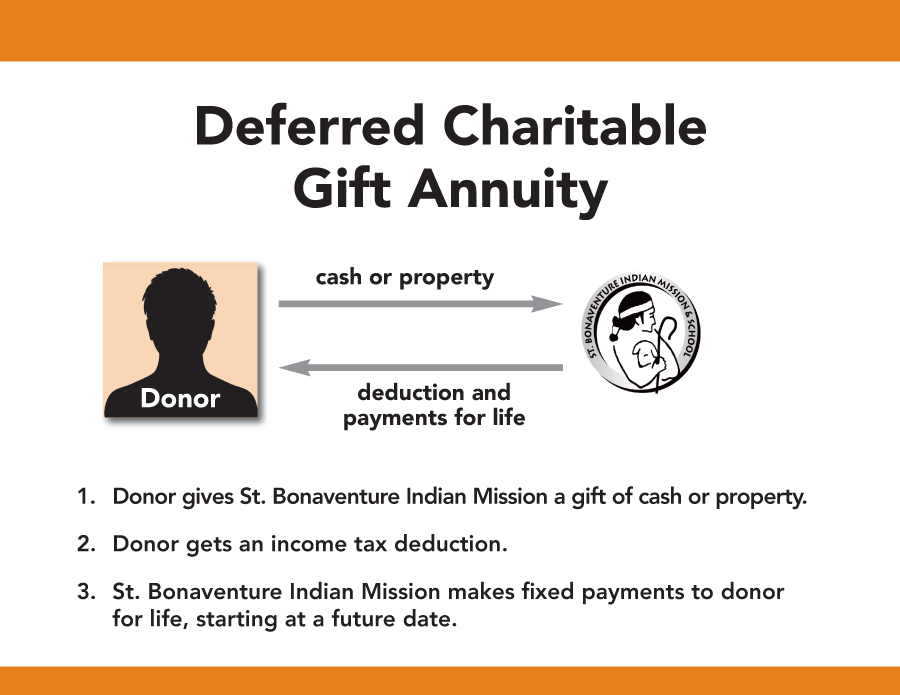

Summary of Gift Plan Income Tax Deduction Capital Gains Consequences Federal Taxation Transfer Taxes Tax Returns Best Funding Assets Special Considerations |

Summary of Gift Plan Income Tax Deduction Capital Gains Consequences Federal Taxation Transfer Taxes Tax Returns Best Funding Assets Special Considerations |

Summary of Gift Plan Income Tax Deduction Capital Gains Consequences Federal Taxation Transfer Taxes Tax Returns Best Funding Assets Special Considerations |

Summary of Gift Plan Income Tax Deduction Capital Gains Consequences Federal Taxation Transfer Taxes Tax Returns Best Funding Assets Special Considerations |

- Learn More

- Recent Tax Laws

- Personal Planning Ideas

- IRA Charitable Rollover

- Best Assets for Giving

- Charitable Gift Annuity

- Gifts That Pay You Income

- Gifts from Estate Plans

- Free Online Courses

- Estate Planning Lessons

- Estate Planning for Women

- Practical Pointers

- Design Your Gifts

- Chart Your Path

- Important Terms

- Facts for Advisors

- Seasons of Life

- Library and Resources

- Donor Stories

- Help Desk

- What’s New

- Contact Us

- Home