Gifts That Pay You Income

Retain Lifetime Payments from Your Gift

Many generous donors would like to do more to provide for our future, but feel they can’t afford to make larger gifts at this time. There are several options, however, that allow friends to make gifts today, retain payments for life and have the satisfaction of knowing that their gifts will provide a lasting benefit to our programs. These “life-income” gifts often permit donors to make larger gifts than they thought possible. Depending on how your gift is arranged, you can plan for:

- Increased income for your family;

- Capital gains tax avoidance;

- Minimized taxes on your income;

- Increased income at retirement;

- Diversion of income to someone in a low tax bracket;

- Gift tax and estate tax savings;

- A hedge against inflation;

- Reduced probate costs;

- Support for grandchildren with college expenses.

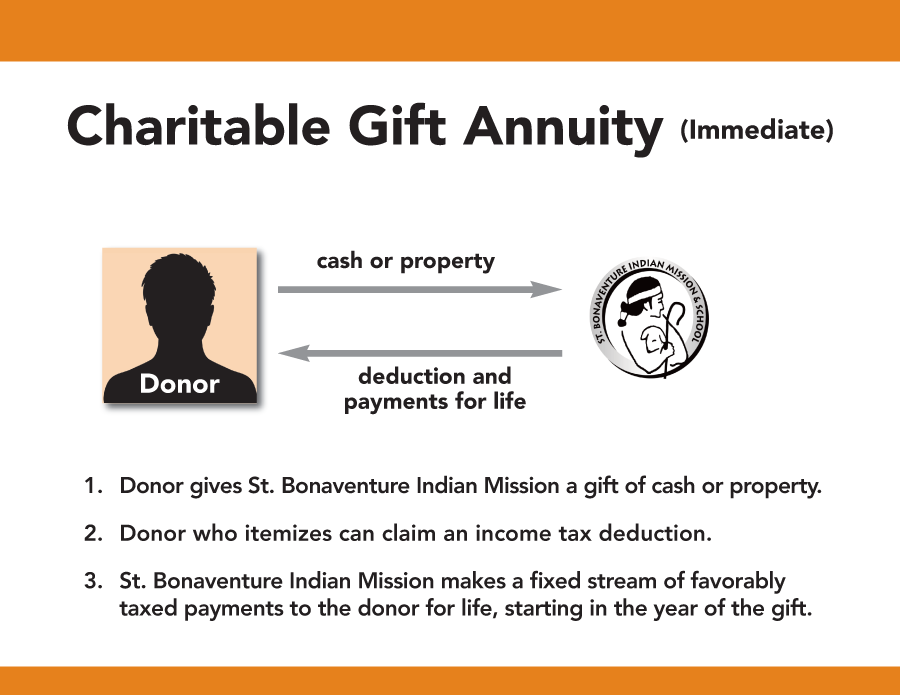

Charitable Gift Annuities

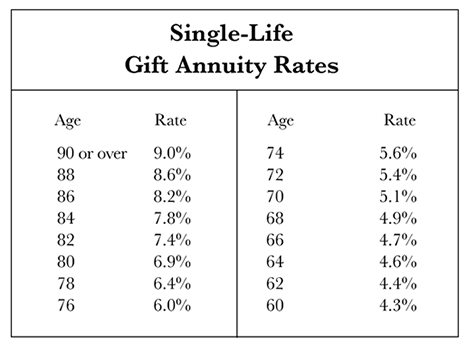

A charitable gift annuity is simply an arrangement whereby, in exchange for your gift of cash, stock or other property, we agree to make fixed payments for life to one or two individuals. For example, if you make a gift today, we will pay an annuity based on your age when the gift annuity is established (check chart below). Or we will pay the annuity to you and another for your joint lives. Among the other benefits of a charitable gift annuity:

- An income tax charitable deduction for a portion of the amount contributed;

- Part of the annuity payment you receive each year will be tax-free for your life expectancy;

- If your gift annuity is funded with appreciated stock held more than one year, you avoid a portion of the capital gains tax that you would owe if you sold the stock; your annuity payments are based on the full value of the shares;

- You provide important support for our future.

Most donors establish gift annuities for themselves (or themselves and a spouse), but the charitable gift annuity is an extremely versatile gift technique that can address a number of planning challenges. Gift annuities can be established to benefit another person (an elderly parent, for example) and can be funded through an estate plan, providing lifetime payments to a family member or friend. Your gift annuity can be a statement of your concern not only for our future, but for those who are important in your life.

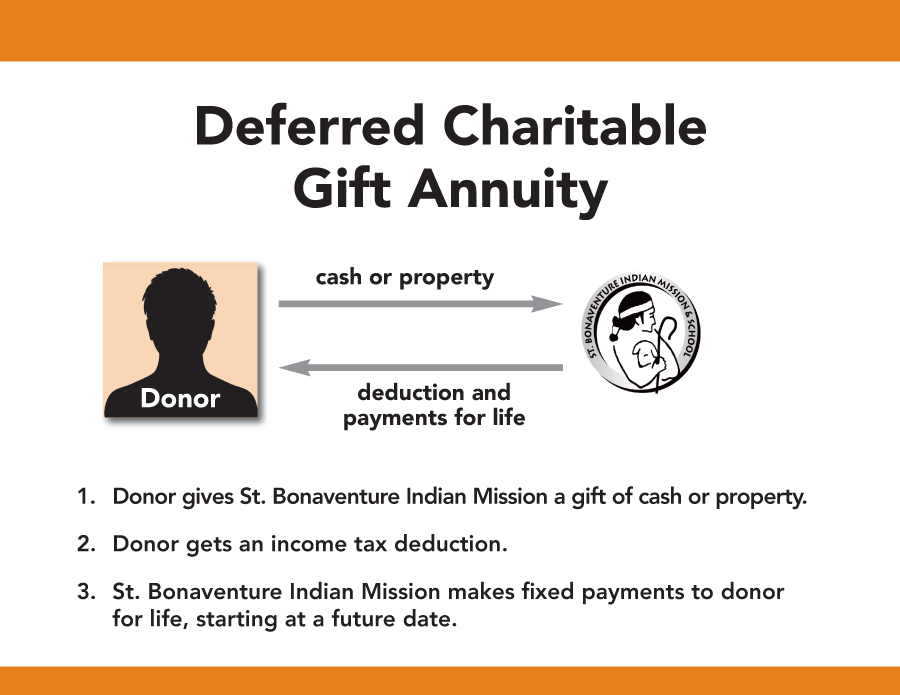

Deferred Payment Charitable Gift Annuities

Most charitable gift annuities begin payments in the year of the gift, but it’s also possible to postpone the start of payments until some later date — retirement, for example. Not only is the charitable deduction larger when the start of the gift annuity is deferred, but payments are also increased. A deferred payment gift annuity is an excellent way to shift income from your high earning years to retirement, augmenting your IRA, 401(k) and other retirement savings. Unlike an IRA contribution, your deferred payment gift annuity can be funded with appreciated stock, for added tax savings.

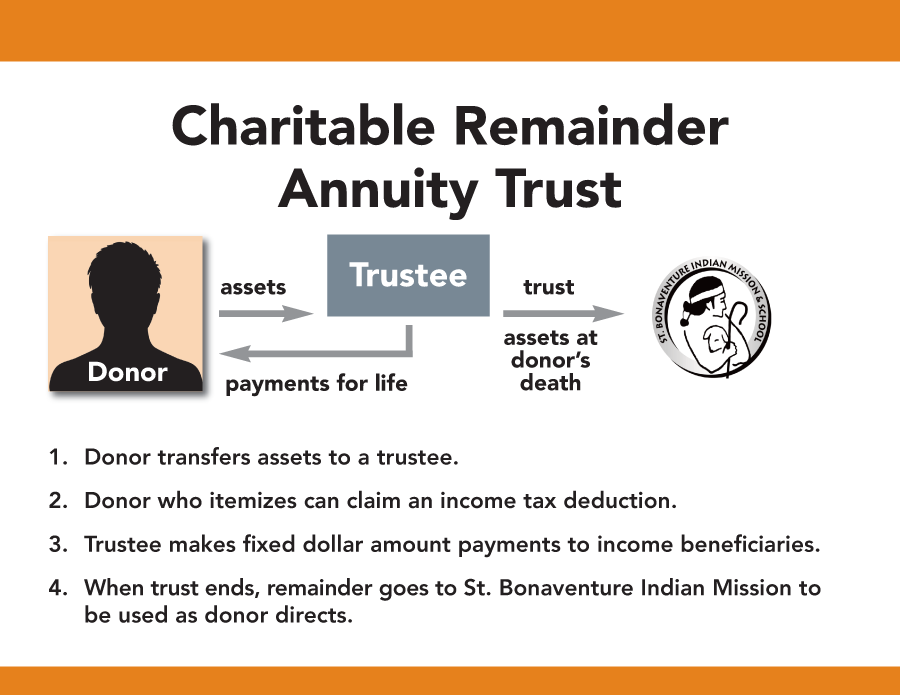

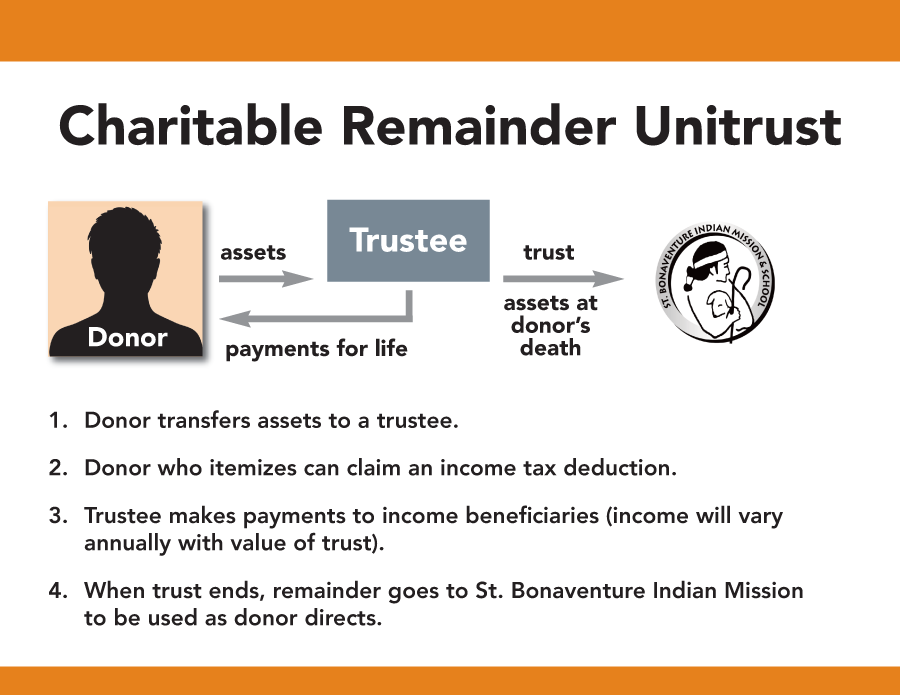

Charitable Remainder Trusts

Charitable remainder trusts offer either fixed payments (annuity trusts) or payments that fluctuate with the changing value of the trust assets (unitrusts). The payments can last for your life or for a term of up to 20 years. Trusts can be funded with cash or appreciated property such as stocks, bonds, mutual fund shares, real estate or just about anything of value. Annuity trusts must pay at least 5% of the amount contributed to the trust annually, while unitrust payments must be at least 5% of the annual value of the assets. If you fund a charitable remainder trust with appreciated assets, the trustee can sell and reinvest, with no loss to capital gains tax. When the trust ends, the assets pass to us outright, to be used in programs you specify. Donors are entitled to an income tax charitable deduction for the value of our remainder interest in the trust. The exact amount depends on the age or ages of those receiving payments and the amount of the payments. Like charitable gift annuities, charitable remainder trusts can be created during life or in an estate plan, with payments made to loved ones.

Remainder interest in home or farm

Although a gift of a residence or farm with a retained life estate does not pay income to the donor, it does allow a donor to make a gift — and take a current income tax deduction — while continuing to use the property for life or rent it out for income. The home can be the donor’s principal residence or vacation property. Donors who give their farms are able to continue farming the land or receiving rental income. It’s also possible to leave us the property in a will or trust, while reserving a lifetime use by a family member.

Life-income gifts such as charitable gift annuities and charitable remainder trusts can be used in a number of ways to address specific financial and family situations. Please call us before you sell and reinvest securities or real estate. We can help you plan a gift that is right for you, your family and our future.

- Learn More

- Recent Tax Laws

- Personal Planning Ideas

- IRA Charitable Rollover

- Best Assets for Giving

- Charitable Gift Annuity

- Gifts That Pay You Income

- Gifts from Estate Plans

- Free Online Courses

- Estate Planning Lessons

- Estate Planning for Women

- Practical Pointers

- Design Your Gifts

- Chart Your Path

- Important Terms

- Facts for Advisors

- Seasons of Life

- Library and Resources

- Donor Stories

- Help Desk

- What’s New

- Contact Us

- Home